Introduction to CFA

The Chartered Financial Analyst (CFA) designation stands as a beacon of excellence in the dynamic world of finance. CFA signifies a commitment to expertise, ethics, and professionalism that holds unparalleled significance in the industry.

From investment analysis to portfolio management, CFA encompasses a comprehensive spectrum of financial knowledge is what makes CFA truly remarkable and is globally recognized.

Employers around the world value the rigor of the program, knowing that CFA charter holders possess not only a deep understanding of finance but also an unwavering dedication to ethical standards.

This designation opens doors to a multitude of opportunities, whether in prestigious investment firms or multinational corporations. It’s more than just letters after your name; it’s an assurance of proficiency that resonates across borders and industries.

- Understanding the Chartered Financial Analyst(CFA) program

- Advantages of being a CFA charter holder

- Global Finance Careers with a Chartered Financial Analyst Program:

- Career Path

- Chartered Financial Analyst Exam Preparation

- The Importance of CFA Program Networking and Ongoing Education

- Ethical Standards and code of conduct in the Chartered Financial Analyst program

- Career Opportunities and Advancement for Chartered Financial Analyst Charterholders

- A Day in the Life of a Chartered Financial Analyst:

- Conclusion and Encouragement: Paving Your Path to Financial Excellence

- FAQs

Understanding the Chartered Financial Analyst(CFA) program

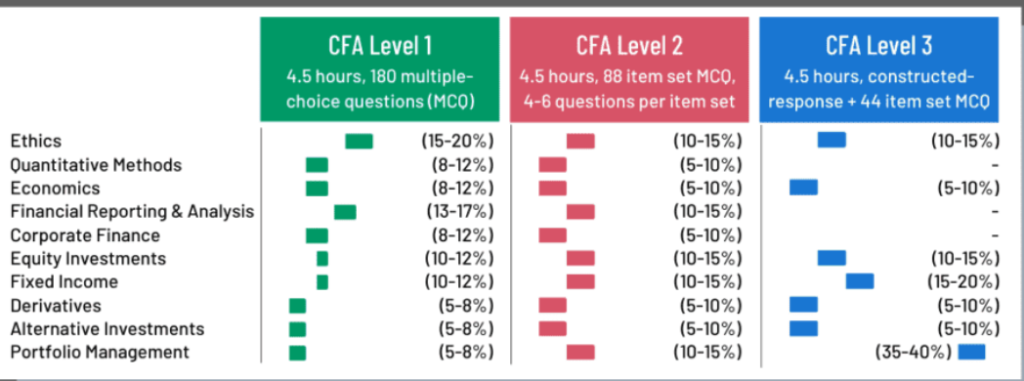

The CFA program, designed to sculpt financial leaders, consists of three comprehensive levels of exams. This educational journey equips aspiring professionals with a profound understanding of investment management and ethics.

- The first level introduces fundamental concepts across various areas, including economics, ethics, and quantitative methods.

- Progressing to level two, candidates dive deeper into asset valuation techniques and gain proficiency in applying these methods.

- The final level crowns this educational expedition by focusing on portfolio management and the synthesis of complex information into effective investment decisions.

This multi-tiered structure not only ensures a solid grasp of financial principles but also fosters the development of critical analytical skills. The recommended study timeline for each level varies demanding dedication and discipline. Embarking on the CFA journey means embracing a commitment to the highest ethical standards and a quest for excellence in financial expertise.

Becoming a CFA charter holder opens a gateway to a realm of advantages and opportunities in the finance universe. With this distinguished designation, individuals gain a compelling edge in the competitive job market. Employers worldwide hold CFA charter holders in high esteem due to their proven expertise and commitment to ethical standards.

Here is the curriculum link https://www.cfainstitute.org/en/programs/cfa/curriculum

This reverence translates into enhanced job prospects and career advancement avenues. Moreover, the CFA program equips professionals with an extensive toolkit of financial knowledge, perfectly positioning them to thrive in the ever-evolving financial landscape.

The CFA charter isn’t merely a credential; it’s a symbol of dedication, recognized globally, and capable of unlocking higher earning potential. Embracing the CFA journey means embracing a future full of promising growth and remarkable success.

Advantages of being a CFA charter holder

- Improved employment prospects and higher income potential

- The CFA is acknowledged worldwide.

- Get consistent updates from the CFA Institute.

- Initiate your personal portfolio management service.

- Facilitates the progression of your professional journey.

- Gain numerous distinctive networking chances.

- Exempt from licensing prerequisites as a CFA professional.

- It offers greater cost efficiency and time savings compared to an MBA.

CFA Programs https://www.cfainstitute.org/en/programs/cfa

Global Finance Careers with a Chartered Financial Analyst Program:

The Chartered Financial Analyst (CFA) charter isn’t just a ticket to a career; it’s a passport to a world of global opportunities. Its recognition spans continents, amplifying career mobility for professionals in the finance realm.

From bustling financial capitals to emerging markets, the CFA designation is a universal language spoken and valued by employers across borders. Its international acclaim translates to limitless possibilities in diverse industries.

CFA charter holders can excel in roles ranging from investment banking, where their analytical prowess shines, to asset management, where their insights drive successful portfolio strategies.

Thriving in private equity becomes natural for them, thanks to their deep understanding of valuation. Even corporate finance doors swing open, with charter holders making informed strategic decisions. The CFA charter isn’t bound by geography; it’s the key to unlocking a world brimming with global career opportunities.

Career Path

- Investment banker

- Portfolio Manager

- Risk Manager

- Market Research Analyst

- Private Banker

- Business Analyst

- Equity Analyst

- Finance Manager

- Chartered Financial Analyst

- Q&A Expert

Chartered Financial Analyst Exam Preparation

Preparing for the CFA exams demands both strategy and dedication. To conquer this rigorous journey, effective study techniques are vital.

- Break down the syllabus into manageable sections and create a study plan that allocates sufficient time to each.

- Prioritize practice questions and mock exams to hone your problem-solving skills.

- Efficient time management is your ally; set aside focused study periods while balancing work or other commitments.

- Leverage diverse resources like textbooks, online courses, and study groups to gain multifaceted insights.

- Remember, CFA exams are a marathon, not a sprint. The commitment required is substantial, but the rewards are commensurate.

- Dedicate ample time for each exam level, gradually mastering the intricacies.

This comprehensive approach doesn’t just ensure success; it solidifies your expertise, equipping you for a triumphant journey as a CFA charter holder.

The Importance of CFA Program Networking and Ongoing Education

The CFA journey isn’t solitary; it’s a gateway to a thriving professional network. The CFA community encompasses like-minded individuals passionate about finance. This invaluable network offers unparalleled opportunities for networking, knowledge exchange, and mentorship.

Connecting with fellow charterholders and candidates opens doors to diverse insights and collaborations. Moreover, the CFA Institute offers an array of resources that go beyond exams. These resources aid in continuous professional development, ensuring you stay at the forefront of industry trends.

From research publications to webinars and workshops, they empower you to evolve alongside the dynamic financial landscape. Embrace this community, for within it lies a wealth of support, learning, and the chance to foster relationships that nurture your growth as a finance professional.

Discover CFA Institute Membership Benefits https://www.cfainstitute.org/en/membership

Ethical Standards and code of conduct in the Chartered Financial Analyst program

In the intricate realm of finance, ethics form the cornerstone of trust and integrity. The CFA program recognizes the profound role ethics play in the profession and instils a strong ethical foundation in its candidates. Upholding the highest standards of conduct is not just a choice; it’s a mandate for CFA charter holders.

The CFA Institute’s Code of Ethics and Standards of Professional Conduct serves as a compass, guiding professionals through the intricate maze of decision-making. These principles are designed to safeguard investors, clients, and the market as a whole.

By adhering to these principles, charter holders demonstrate an unwavering commitment to honesty, objectivity, and fairness. This ethical framework not only defines the character of a CFA charter holder but also ensures the preservation of trust and the stability of the financial industry.

Code of Ethics and standards: https://www.cfainstitute.org/en/ethics-standards/ethics/code-of-ethics-standards-of-conduct-guidance

Career Opportunities and Advancement for Chartered Financial Analyst Charterholders

The Chartered Financial Analyst (CFA) charter opens doors to a realm of diverse and rewarding career paths in the dynamic world of finance. With a CFA designation, you aren’t limited to a single track; your expertise is applicable across various sectors and industries. Here are some exciting avenues that await CFA charter holders:

- Investment Management:

- Manage investment portfolios for institutional clients or individuals.

- Make strategic investment decisions to achieve optimal returns while mitigating risks.

- Roles include Portfolio Manager, Investment Analyst, and Fund Manager.

- Financial Analysis:

- Conduct in-depth financial research and analysis to guide investment decisions.

- Evaluate company financials, market trends, and economic indicators.

- Opportunities as Financial Analyst, Research Analyst, and Equity Analyst.

- Portfolio Management:

- Oversee investment portfolios, ensuring alignment with clients’ objectives.

- Implement strategies to optimize portfolio performance and asset allocation.

- Roles include Portfolio Manager, Wealth Manager, and Asset Allocation Specialist.

- Private Equity:

- Participate in identifying, evaluating, and investing in private companies.

- Active involvement in the growth and management of portfolio companies.

- Positions such as Private Equity Associate, Investment Manager, and Venture Capitalist.

- Corporate Finance:

- Make strategic financial decisions within organizations to enhance profitability and value.

- Roles encompass Financial Planning Manager, Treasury Analyst, and Corporate Development.

Obtaining the CFA charter doesn’t just unlock job opportunities; it propels your career forward:

- Enhanced Job Prospects: The CFA designation is recognized globally and valued by employers in various industries, increasing your marketability.

- Career Advancement: The rigorous CFA curriculum equips you with advanced skills, positioning you for roles with higher responsibilities and influence.

- Higher Earning Potential: CFA charterholders often command higher salaries due to their specialized knowledge and proven expertise.

The journey to becoming a CFA charter holder signifies more than a career choice; it’s an investment in the future brimming with diverse opportunities and boundless growth.

A Day in the Life of a Chartered Financial Analyst:

Ever wondered what a day looks like for a Chartered Financial Analyst (CFA)? From analyzing market trends to making strategic investment decisions, a CFA’s journey is dynamic and full of excitement. Here’s a glimpse:

- Morning Routine:

- Start the day early with a review of financial news and updates.

- Check pre-market indicators and global economic events that could impact the day’s activities.

- Research and Analysis:

- Dive into researching company financials, industry trends, and economic indicators.

- Analyze data to make informed investment recommendations for clients or the portfolio.

- Client Interaction:

- Consult with clients to understand their financial goals and risk tolerance.

- Present investment strategies aligned with their objectives, addressing queries and concerns.

- Portfolio Management:

- Monitor the performance of investment portfolios throughout the day.

- Make real-time adjustments based on market movements and changing economic conditions.

- Collaboration:

- Collaborate with colleagues, such as research analysts and portfolio managers, to exchange insights and validate strategies.

- Meetings and Presentations:

- Participate in meetings with team members, discussing investment strategies and performance.

- Present investment recommendations to clients or stakeholders, backed by meticulous analysis.

- Continuous Learning:

- Dedicate time to ongoing education, staying updated with industry trends and regulatory changes.

- Participate in webinars, seminars, or research sessions provided by the CFA Institute.

- Ethical Considerations:

- Ensure all decisions and actions align with the CFA Institute’s Code of Ethics and Standards of Professional Conduct.

- End-of-Day Review:

- Reflect on the day’s activities, evaluating the effectiveness of strategies and decisions made.

- Personal Development:

- Use evenings for personal growth, reading industry publications, or engaging in networking events.

If you are interested to learn more about other careers, navigate through this website https://futurereadytools.com/category/careers/

Conclusion and Encouragement: Paving Your Path to Financial Excellence

In the journey through the realms of the Chartered Financial Analyst (CFA) program, we’ve uncovered a tapestry of opportunities and growth. Let’s recap the key takeaways that highlight the significance of embracing the CFA path:

- Expertise Beyond Borders: The CFA designation isn’t just a credential; it’s a global mark of proficiency recognized across industries and continents.

- Versatile Career Paths: From investment management to private equity, a CFA opens doors to diverse roles, fueling both your passion and career trajectory.

- Ethics at the Core: Upholding the highest ethical standards isn’t a choice; it’s the essence of being a CFA charter holder.

- Success Stories Speak: Real-life success stories and testimonials from CFA professionals underscore the transformative impact of the designation.

Now, stand at the crossroads with a realization: the CFA program isn’t just a curriculum; it’s a gateway to a fulfilling career in finance. The rigor, dedication, and ethics embedded in the program lay the foundation for your journey to excellence. So, as you contemplate your future in the financial universe, remember that the CFA program isn’t merely an option; it’s a strategic choice, a stepping stone toward a prosperous and rewarding career that holds the power to shape not just your future, but the financial world at large.

FAQs

1. What is the CFA designation?

The CFA designation is a professional designation awarded by the CFA Institute to individuals who have met the rigorous academic, ethical, and professional standards of the program. The CFA charterholder is a globally recognized standard of excellence for investment professionals.

2. What are the benefits of becoming a CFA charterholder?

There are many benefits to becoming a CFA charterholder. Some of the most common benefits include:

- Increased earning potential: CFA charterholders typically earn higher salaries than non-CFAs.

- Increased job opportunities: CFA charterholders are in high demand by employers in the financial industry.

- Enhanced credibility: CFA charterholders are seen as experts in investment analysis and portfolio management.

- Professional development: The CFA Program provides a rigorous education in investment management that can help you advance your career.

- Personal satisfaction: Becoming a CFA charterholder is a challenging but rewarding experience that can boost your confidence and sense of accomplishment.

3. What are the CFA exam levels?

The CFA Program consists of three levels of exams: Level I, Level II, and Level III. Each level is designed to test your knowledge and skills in a specific area of investment analysis and portfolio management.

- Level I: This level covers the fundamentals of investment analysis, including ethics, quantitative methods, economics, and financial statement analysis.

- Level II: This level covers more advanced topics in investment analysis, including corporate finance, equity analysis, fixed income analysis, and derivatives.

- Level III: This level covers the most advanced topics in investment analysis, including portfolio management, alternative investments, and wealth planning.

4. How long does it take to become a CFA charter holder?

The CFA Program is a challenging and demanding program that typically takes 3-4 years to complete. However, some candidates may be able to complete the program in less time, while others may need more time.

5. What is the CFA curriculum?

The CFA curriculum is designed to provide a comprehensive education in investment analysis and portfolio management. The curriculum covers a wide range of topics, including:

- Ethics and professional standards

- Quantitative methods

- Economics

- Financial statement analysis

- Corporate finance

- Equity analysis

- Fixed income analysis

- Derivatives

- Alternative investments

- Portfolio management

- Wealth planning

6. What is the CFA pass rate?

The CFA pass rate varies by level, but it is typically around 40%. The pass rate is lower for Level III, which is the most challenging level.

7. How much does it cost to become a CFA charterholder?

The cost of the CFA Program varies depending on the level of the exam and the country where you take the exam. However, the total cost is typically around $2,000-$3,000.

8. What are the job prospects for CFA charterholders?

The job prospects for CFA charter holders are excellent. CFA charter holders are in high demand by employers in the financial industry, and they can command high salaries. Some of the most common jobs for CFA charter holders include:

- Investment analyst

- Portfolio manager

- Financial consultant

- Risk manager

- Research analyst

- Wealth advisor

9. What are the top employers of CFA charter holders?

Some of the top employers of CFA charter holders include:

- Goldman Sachs

- Morgan Stanley

- JP Morgan Chase

- Bank of America

- Citigroup

- UBS

- BlackRock

- State Street

- Fidelity Investments

- Vanguard Group *Dimensional Fund Advisors

10. Where is the CFA most demanded?

The CFA is most demanded in the United States, Europe, and Asia. However, there is a growing demand for CFA charter holders in other regions, such as Latin America and Africa.