Introduction

In the world of finance and accounting, few titles hold as much prestige and influence as that of a Chartered Accountant (CA). These financial experts work behind the scenes to ensure sound financial health and compliance of businesses and organizations across the globe. In this article, we embark on a journey to explore the world of Chartered Accountancy, uncovering what it takes to become one, the pivotal role they play in the financial landscape, and the endless possibilities this profession offers.

A Chartered Accountant, commonly referred to as a CA, is a finance and accounting professional who has undergone rigorous training, education, and examinations to earn their designation.

Recorded interview with my school mate Ranjini Vishwanath – CA.

Educational Qualifications and Entrance Exams for Chartered Accountancy (CA) in India

Embarking on the journey to become a Chartered Accountant in India is an intellectually rewarding pursuit that demands a solid foundation in finance, accounting, and a deep commitment to the profession. In this section, we will explore the educational qualifications necessary to begin this journey and the specific entrance exams that act as the gateway to the CA program.

Educational Qualifications for CA

To lay the groundwork for a career as a Chartered Accountant, aspiring candidates typically need to meet specific educational qualifications:

- 10+2 or Equivalent: The first step is to complete your 10+2 (or its equivalent) from a recognized educational board. It’s crucial to perform well in your 10+2 exams, as these scores will play a part in your CA entrance exam eligibility.

- Bachelor’s Degree: After 10+2, you’ll need to pursue a bachelor’s degree. While many CA aspirants opt for a Bachelor of Commerce (B.Com) degree, other related fields like economics, business administration, or even engineering are also accepted. A strong foundation in accounting, finance, and mathematics is essential.

- Minimum Marks Requirement: To be eligible for the CA program, you must meet minimum marks criteria in your 10+2 and bachelor’s degree. These criteria can vary, so it’s advisable to check the latest guidelines from the Institute of Chartered Accountants of India (ICAI).

Entrance Exams for CA

Once you’ve met the educational qualifications, you’ll need to clear specific entrance exams to enrol in the CA program. The most prominent entrance exams are:

- Common Proficiency Test (CPT): CPT is the entry-level exam for Chartered Accountancy. It covers four subjects: Accounting, Mercantile Laws, General Economics, and Quantitative Aptitude. It is designed to assess your fundamental knowledge and aptitude for pursuing CA.

- Foundation Course: In recent years, CPT has been replaced by the Foundation Course. It is the first level of the CA program and includes four papers: Principles and Practice of Accounting, Business Laws and Business Correspondence, Business Mathematics and Logical Reasoning, and Business Economics and Business and Commercial Knowledge.

- Eligibility for Entrance Exams: To be eligible for CPT or the Foundation Course, you must have completed your 10+2 or equivalent and registered for the CA program with ICAI.

- Passing Criteria: Candidates need to secure a minimum prescribed percentage to pass these exams. It’s important to note that these entrance exams have multiple-choice questions and negative marking for incorrect answers, so a strategic approach to studying is beneficial.

- External Links: For the most up-to-date information on educational qualifications and entrance exams, you can refer to the official website of the Institute of Chartered Accountants of India (ICAI): ICAI Official Website.

Career Opportunities for Chartered Accountants in India

The pursuit of becoming a Chartered Accountant (CA) in India not only signifies a commitment to financial expertise but also opens the doors to a world of diverse and rewarding career opportunities. CAs are in high demand across various industries, making them one of the most sought-after professionals in the Indian job market. In this section, we will delve into the extensive range of career prospects that await those who earn the coveted CA designation.

Versatility Across Industries

One of the most striking aspects of a CA’s career path is its versatility. CAs are equipped with a unique skill set that transcends industries, enabling them to play pivotal roles in different sectors of the economy. Here are some prominent career avenues for CAs in India:

1. Public Accounting Firms: Public accounting firms like the “Big Four” (Deloitte, PwC, Ernst & Young, and KPMG) are among the largest employers of CAs in India. As auditors, CAs examine the financial records of clients, providing assurance on financial integrity and compliance.

2. Corporate Finance: Many CAs find their niche within corporate finance departments of companies across industries. They are instrumental in financial planning, budgeting, risk management, and ensuring regulatory compliance.

3. Tax Consultancy: With India’s complex tax laws, CAs specializing in taxation are highly sought after. They provide expertise in tax planning, filing, and helping businesses optimize their tax structures.

4. Management Consultancy: CAs with strong analytical and strategic thinking skills excel in management consultancy. They offer guidance on operational efficiency, financial management, and business growth strategies.

5. Entrepreneurial Ventures: CAs often venture into entrepreneurship, leveraging their financial acumen to start their businesses or consult startups on financial matters.

6. Banking and Financial Services: CAs are in demand in banks, financial institutions, and investment firms, where they assess credit risks, evaluate investment opportunities, and manage financial portfolios.

7. Government and Public Sector: The government sector also offers promising opportunities for CAs in roles related to auditing, taxation, and financial management.

8. Teaching and Academia: Experienced CAs often take up teaching roles in universities and professional institutes, sharing their knowledge and expertise with the next generation of CAs.

Real-Life Examples

To illustrate the real-world impact of CAs in India, consider these examples:

- Naina Lal Kidwai: A prominent CA, Naina Lal Kidwai, went on to become the first woman to head a foreign bank in India as the Country Head of HSBC India. Her career path showcases the leadership potential of CAs.

- Deepak Parekh: The Chairman of HDFC Group, Deepak Parekh, is a distinguished CA known for his contributions to the Indian financial sector. His leadership exemplifies how CAs can shape the finance industry.

- Rakesh Jhunjhunwala: Known as the “Warren Buffett of India,” Rakesh Jhunjhunwala is a CA turned stock market investor. His success story highlights how CAs can excel in investment and wealth management.

Essential Soft Skills and Competencies for a Successful CA Career

Becoming a Chartered Accountant (CA) in India is not just about mastering financial concepts and passing exams; it’s also about developing a comprehensive set of soft skills and competencies that are crucial for success in the profession. In this section, we will explore the essential soft skills and competencies required for a thriving CA career.

1. Analytical Skills

Analytical skills are the bedrock of a CA’s work. CAs must be able to dissect complex financial data, identify trends, and make data-driven decisions. This skill enables them to provide valuable insights to clients and organizations.

To enhance your analytical skills, consider reading financial reports, case studies, and industry analyses regularly. Practicing with sample financial statements and conducting financial ratio analysis can also sharpen your analytical abilities.

2. Communication Skills

A CA’s job often involves explaining complex financial concepts to clients, colleagues, and non-finance professionals. Effective communication is essential for conveying information clearly and persuasively.

Explore resources on effective communication, including books and online courses. Practice explaining financial concepts to non-finance friends or family to improve your ability to simplify complex ideas.

3. Attention to Detail

Attention to detail is paramount in accounting and auditing. CAs must meticulously review financial documents, ensuring accuracy and compliance with regulations.

Develop your attention to detail by reviewing financial statements, contracts, and tax returns thoroughly. Consider using checklists and audit software to help you stay organized and focused.

4. Ethical Behavior

Ethical behavior is a non-negotiable aspect of a CA’s career. CAs are bound by a strict code of conduct and must maintain the highest ethical standards in their professional practice.

Familiarize yourself with the Code of Ethics for Chartered Accountants in India provided by ICAI. Keep up with updates and case studies related to ethical issues in the field.

5. Time Management

CA professionals often juggle multiple tasks and deadlines. Effective time management is essential for meeting client expectations and maintaining work-life balance.

Explore time management techniques, such as the Eisenhower Matrix or the Pomodoro Technique. Implement digital tools and calendars to schedule and prioritize tasks.

6. Problem-Solving Skills

In the dynamic world of finance, CAs frequently encounter complex problems that require creative solutions. Strong problem-solving skills enable CAs to navigate challenges effectively.

Practice problem-solving by working on financial case studies and real-world scenarios. Seek out resources on critical thinking and decision-making to enhance your problem-solving abilities.

7. Leadership and Teamwork

CAs often work in teams and may lead audits or financial projects. Effective leadership and teamwork skills are essential for collaboration and project success.

Join team-based activities or clubs to improve your teamwork skills. Participate in leadership development programs and workshops to enhance your leadership abilities.

8. Adaptability and Continuous Learning

The financial landscape is constantly evolving with changing regulations and technologies. CAs must stay adaptable and committed to continuous learning to stay relevant.

Stay updated by reading financial news, attending seminars, and enrolling in relevant courses or certifications. Embrace new technologies and software tools to streamline your work processes.

Chartered Accountants and Artificial Intelligence

Artificial Intelligence (AI) has been making significant inroads into various industries, including finance and accounting. Its impact on the job of Chartered Accountants (CAs) is multifaceted, influencing both the nature of their work and the skills they need to excel in their profession. Here’s how AI is impacting the job of Chartered Accountants:

- Automation of Repetitive Tasks:

- Data Entry and Processing: AI-powered software can automate data entry, reducing the time CAs spend on routine bookkeeping tasks.

- Transaction Matching: AI algorithms can match transactions, reconcile accounts, and detect anomalies, which traditionally required manual effort.

- Enhanced Data Analysis:

- Advanced Analytics: AI can analyze vast datasets quickly, enabling CAs to derive deeper insights from financial data, detect patterns, and make more informed decisions.

- Predictive Analytics: AI algorithms can predict future financial trends and help CAs develop more accurate financial forecasts.

- Improved Audit Procedures:

- Automated Auditing Tools: AI-driven audit software can scan and analyze financial records more thoroughly, reducing the risk of errors and fraud.

- Anomaly Detection: AI can flag unusual transactions or discrepancies, allowing auditors to focus their efforts on high-risk areas.

- Efficient Compliance and Reporting:

- Tax Compliance: AI can assist in tax compliance by keeping up with changing tax laws and regulations and automating tax calculations.

- Financial Reporting: AI can streamline financial reporting processes, ensuring compliance with accounting standards.

- Client Advisory Services:

- Strategic Insights: With routine tasks automated, CAs can focus on providing strategic financial advice to clients, helping them make informed decisions.

- Risk Assessment: AI tools can assess and manage financial risks more effectively, guiding clients toward risk mitigation strategies.

- Ethical and Governance Considerations:

- Data Privacy: CAs need to ensure that AI systems handling sensitive financial data comply with data privacy regulations.

- Ethical Use of AI: CAs must consider the ethical implications of AI, including transparency, fairness, and accountability in automated financial decisions.

- Continuous Learning and Adaptation:

- AI Proficiency: CAs must acquire a working knowledge of AI and data analytics to effectively use AI tools and understand their limitations.

- Ethical and Regulatory Updates: Staying current with AI-related ethical standards and regulations is essential.

- New Career Opportunities:

- AI in Finance: AI’s integration into finance creates opportunities for CAs to specialize in AI-related roles, such as financial data analysts or AI auditors.

- Client Expectations:

- Tech-Savvy Clients: Clients may expect CAs to leverage AI to enhance efficiency and provide more insightful financial advice.

Take aways

- Chartered Accountancy is not just a profession; it’s a vocation that combines technical prowess with ethical commitment. CAs are the financial architects of our world, shaping the financial landscape for individuals and businesses alike.

- Pursuing a career as a Chartered Accountant in India requires a solid educational foundation and the successful clearance of specific entrance exams. It’s a path that demands dedication, analytical skills, and a passion for finance and accounting.

- A career as a Chartered Accountant in India offers a myriad of opportunities that cater to diverse interests and aspirations. Whether you aim to be a financial strategist, a tax expert, or a business consultant, the CA designation provides the knowledge and credibility needed to thrive in India’s competitive job market.

- The CA program in India is a challenging but rewarding journey that spans multiple stages, each designed to equip aspiring CAs with the knowledge and skills necessary for a successful career in finance and accounting. The examinations at each stage test not only your technical expertise but also your ability to apply that knowledge in real-world scenarios. As you progress through the Foundation, Intermediate, and Final levels, you’ll not only become a subject matter expert but also a trusted financial advisor, capable of making significant contributions to the world of finance and business in India.

- A successful CA career in India goes beyond technical knowledge. It requires a diverse set of soft skills and competencies.

- AI is transforming the role of Chartered Accountants by automating routine tasks, enabling more in-depth data analysis, enhancing audit procedures, and providing opportunities for strategic client advisory services. While AI offers numerous advantages, CAs must also be vigilant about ethical considerations and adapt to evolving technology and client expectations to remain effective and relevant in their profession.

FAQs

- What is a Chartered Accountant (CA)?

A Chartered Accountant (CA) is a professional accountant who has completed a rigorous qualification process and is a member of a professional accounting body, such as the Institute of Chartered Accountants of India (ICAI). CAs are highly skilled in accounting, auditing, taxation, finance, and corporate laws.

- What are the benefits of a career as a CA?

CAs are in high demand across a wide range of industries, and they can expect to earn competitive salaries. CAs also have the opportunity to work in senior positions and to start their own businesses.

- What are the qualifications required to become a CA?

To become a CA in India, you must complete the following steps:

- Pass the Chartered Accountancy Entrance Examination (CA CPT)

- Complete three years of articleship under a practicing CA

- Pass the Chartered Accountancy Final Examination (CA Final)

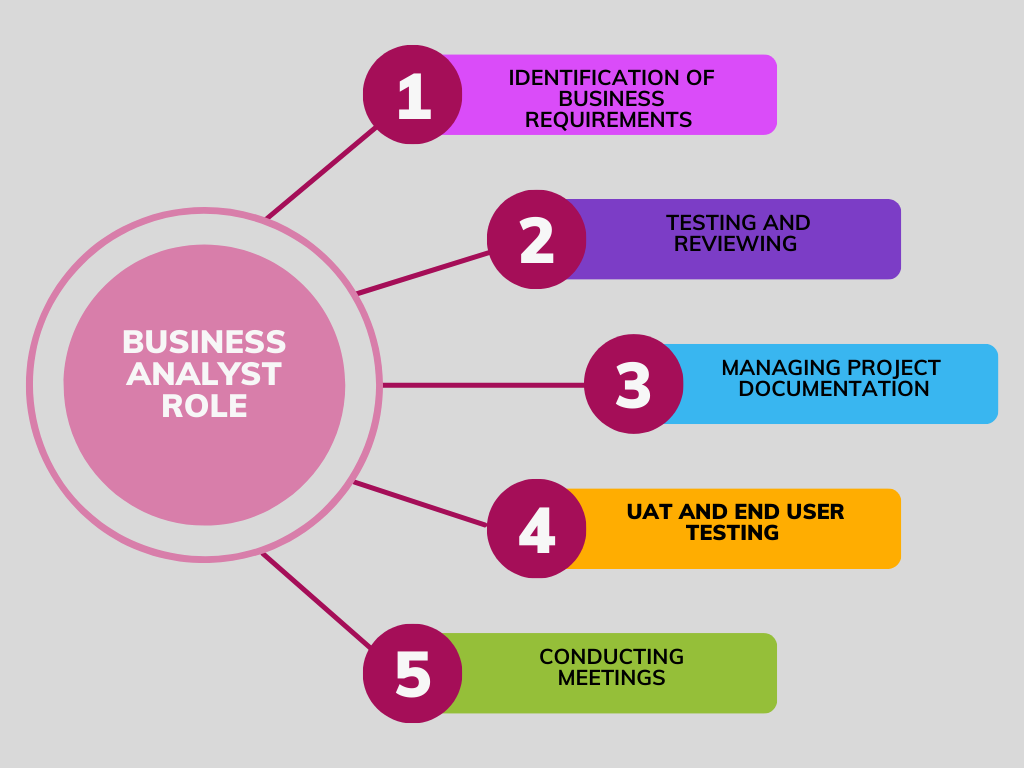

- What are the different types of jobs available to CAs?

CAs can work in a variety of roles, including:

- Auditor

- Accountant

- Tax consultant

- Financial advisor

- Management consultant

- Investment banker

- Corporate finance executive

- Chief financial officer (CFO)

- What are the skills required to be a successful CA?

In addition to technical skills such as accounting, auditing, and taxation, CAs also need to have strong analytical, problem-solving, and communication skills. CAs also need to be able to work independently and as part of a team.

- What is the salary of a CA?

The salary of a CA varies depending on their experience, qualifications, and the industry they work in. However, CAs can generally expect to earn competitive salaries.

- What are the job prospects for CAs?

The job prospects for CAs are excellent. CAs are in high demand across a wide range of industries, and the demand is expected to continue to grow in the coming years.

- How can I prepare for a career as a CA?

There are a number of things you can do to prepare for a career as a CA, including:

- Study accounting, auditing, and taxation at school and college

- Gain work experience in an accounting firm

- Network with CAs and other professionals in the accounting and finance industry

- Stay up-to-date on the latest accounting and financial trends

- What are the challenges of a career as a CA?

The CA qualification is challenging to achieve, and the work of a CA can be demanding. However, the rewards of a career as a CA are significant.

- What are the best career paths for CAs?

There are many different career paths available to CAs. Some of the most popular career paths include:

- Audit

- Taxation

- Financial advisory

- Management consulting

- Investment banking

- Corporate finance