Introduction

Welcome to the exciting world of Fintech Engineering. It’s where technology meets finance, sparking innovation that is revolutionizing the financial industry. So, what’s happening at this intersection? A whole lot!

Fintech, short for ‘financial technology’, is transforming how we manage money. It’s bringing about changes that were once thought impossible. Think about it: who would have imagined banking without stepping into a bank? Today, that’s reality.

Mobile banking is a perfect example. It’s making banking services accessible right from our pockets. Checking balances, transferring funds, or paying bills – it’s all just a tap away. But that’s just the tip of the iceberg.

Cryptocurrencies are another game-changer. Bitcoin, Ethereum, and their digital kin are reshaping the concept of money. They offer a new, decentralized way to store and transfer value.

Then there’s peer-to-peer lending, disrupting traditional loans. It’s making borrowing and lending more personal and flexible. Insurance, too, is being revamped, with insurtech offering tailored policies at your fingertips.

This is the fintech revolution. It’s transforming finance, delivering better, faster, and more accessible services. And this is just the beginning – there’s much more to explore in the rapidly-evolving fintech landscape.

- Defining Fintech Engineering

- The Life of an Engineer in Fintech Engineering

- Building Blocks: Skills for a Fintech Engineering Career

- The Learning Path: Education and Qualifications

- Certifications in Fintech Engineering

- Lifelong Learning

- Plotting Your Career Path in Fintech Engineering

- Fintech Engineering: A Look into the Future

- The Future of Fintech Engineering

- The Fintech Community: Networking Opportunities

- Networking Tips

- Potential Employers in the Fintech Space

- Traditional Companies

- Startups

- A World of Opportunities

- Summary

- Frequently Asked Questions

Defining Fintech Engineering

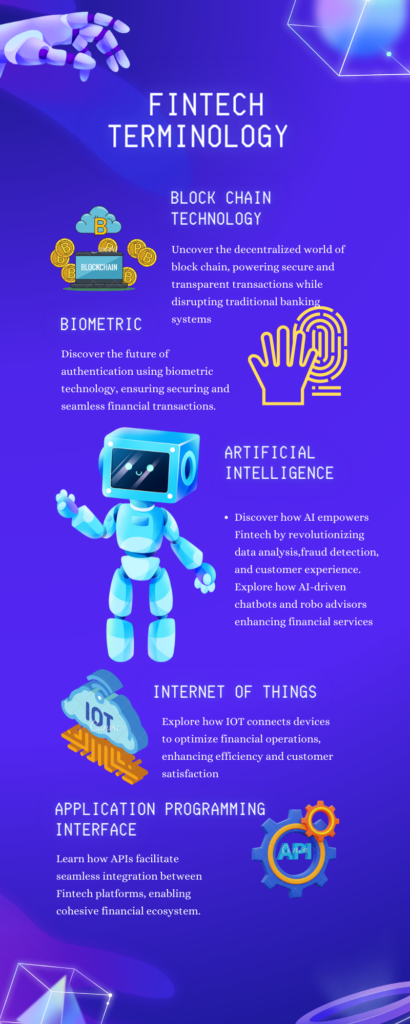

Fintech engineering is an exciting field. But what does it mean? Let’s break it down. At its heart, fintech engineering is a fusion. It combines the world of finance with the power of technology. But there’s a bit more to it. Business acumen plays a key role as well. This synergy creates a dynamic, ever-evolving discipline.

- First, there’s finance. Fintech engineers need to grasp financial concepts, from banking operations to investment strategies. They must understand money, its movement, and its management.

- Then, there’s the technology part. This is where computer science comes in. Fintech engineers use coding languages, work with databases, and design software systems. They use tech to solve financial problems and enhance financial services.

- And don’t forget the business element. Fintech engineers must understand business models, market dynamics, and customer needs. They need to create solutions that are not just technically sound, but also commercially viable.

In short, fintech engineering is about bridging gaps. It links the financial world with the tech world, powered by business insights. It’s about creating innovative, effective, and user-friendly financial solutions for the digital age. It’s where finance, technology, and business come together in harmony.

The Life of an Engineer in Fintech Engineering

Being a fintech engineer is an exciting role. You’re at the forefront of financial innovation. So, what does this role entail? Let’s dive in and explore.

Design and Development

Fintech engineers are creators. They’re builders. Here’s what they typically do in design and development:

- Develop Financial Systems: They use programming languages like Python or Java to build digital solutions. This could range from mobile banking apps to complex trading algorithms.

- Enhance User Interfaces: They focus on creating intuitive and engaging interfaces. This ensures users can navigate financial platforms with ease and efficiency.

- Optimize Systems: They continuously enhance systems for better performance. They strive to make financial transactions faster, smoother, and more reliable.

Data Analysis

Data is at the heart of fintech. It drives decisions and informs strategies. Here’s how fintech engineers work with data:

- Data Mining: They extract valuable information from vast amounts of financial data. This can reveal hidden patterns and insights.

- Predictive Analysis: They use machine learning and AI to predict market trends. This helps businesses make informed decisions.

- Risk Assessment: They analyze data to assess financial risks. This helps companies manage potential threats and challenges.

Cybersecurity

Security is paramount in fintech. Fintech engineers play a crucial role in ensuring this. Here’s how:

- Secure Transactions: They implement encryption and other security measures to protect transactions. They aim to prevent fraud and ensure data privacy.

- Threat Detection: They develop systems to identify and respond to cyber threats. This ensures the company’s financial data remains safe.

- Regulatory Compliance: They ensure that all systems comply with cybersecurity laws and regulations. This protects both the company and its customers.

Industry Trend Analysis

Fintech is a rapidly evolving field. Fintech engineers must stay on top of trends. Here’s what they do:

- Tech Trend Monitoring: They keep an eye on emerging tech trends. From blockchain to AI, they explore how these can be applied in finance.

- Market Research: They analyze market trends to understand customer needs. This informs the development of new fintech solutions.

- Regulatory Updates: They monitor changes in financial regulations. This ensures that their company’s solutions remain compliant and up-to-date.

To sum it up, fintech engineers wear many hats. They’re creators, analysts, protectors, and trend-spotters. It’s a challenging role, but also an immensely rewarding one. They’re not just shaping the future of finance – they’re building it, one line of code at a time.

Building Blocks: Skills for a Fintech Engineering Career

Fintech engineering is an enticing career. But what skills do you need to excel in this field? It’s a combination of both ‘hard’ and ‘soft’ skills. Let’s examine each category in detail.

Hard Skills

These are technical skills – the concrete abilities you need to perform specific tasks. They’re often acquired through education, training, or experience. Here are some key hard skills for a fintech engineer:

- Programming Languages: Fintech engineers need to be adept at one or more languages such as Python, Java, C++, or JavaScript. Each language has its strengths, and the choice often depends on the specific task at hand.

- Data Analysis: Handling and analyzing large datasets is crucial. Skills in SQL, Excel, or data analysis tools like Python’s Panda’s library can be invaluable.

- Machine Learning/AI: As fintech explores predictive analytics and automation, understanding machine learning and AI is becoming more important. Engineers might use tools like TensorFlow or PyTorch for these tasks.

- Cybersecurity: Given the sensitive nature of financial data, knowledge of cybersecurity principles is a must. Fintech engineers need to understand encryption, secure coding practices, and threat detection.

Soft Skills

While hard skills are about ‘what’ you do, soft skills are about ‘how’ you do it. They’re interpersonal or ‘people’ skills. Here are some vital soft skills:

- Problem-Solving: Fintech engineers often face complex challenges. The ability to think critically, approach problems methodically, and devise effective solutions is crucial.

- Communication: Whether it’s explaining a complex concept to a non-technical colleague or writing clear, concise code comments, good communication is key.

- Adaptability: The fintech landscape is constantly changing. Engineers need to be adaptable, ready to learn new technologies, and able to cope with shifting project requirements.

- Teamwork: Fintech projects often involve cross-functional teams. Being able to collaborate effectively with colleagues from various disciplines is vital.

Below is the table for the skills matrix detailing hard and soft skills required for a successful career in Fintech Engineering:

| Skill | Description |

|---|---|

| Programming Languages | Fintech engineers excel in diverse programming languages like Python, Java, C++, or JavaScript. Their expertise empowers them to develop and maintain cutting-edge fintech applications and solutions, driving innovation in the financial industry. |

| Data Analysis | In the fintech realm, handling and analyzing vast financial datasets is pivotal. Proficiency in SQL, Excel, or data analysis tools like Python’s pandas library empowers engineers to make data-driven decisions, uncovering valuable insights for strategic growth and competitive advantage. |

| Machine Learning/AI | Understanding machine learning and AI is essential as fintech explores predictive analytics and automation. Knowledge of tools like TensorFlow or PyTorch aids in building intelligent fintech solutions. |

| Cybersecurity | Given the sensitivity of financial data, knowledge of cybersecurity principles is a must. Fintech engineers need to grasp encryption, secure coding practices, and threat detection to safeguard data. |

| Problem-Solving | Fintech engineers are natural problem solvers, fearlessly embracing complex challenges. Armed with critical thinking and methodical approaches, they skillfully devise effective solutions that address intricate financial requirements and pave the way for seamless operations. |

| Communication | Strong communication skills are vital for explaining technical concepts to non-technical colleagues and writing clear, concise code comments for seamless collaboration in fintech projects. |

| Adaptability | Embracing the ever-changing fintech landscape, engineers thrive on adaptability. As they eagerly learn new technologies, they become agile in adapting to shifting project demands, enabling them to stay at the forefront of fintech innovations and advancements. |

| Teamwork | Collaboration forms the backbone of fintech projects, often spanning cross-functional teams. Fintech engineers excel in teamwork, harmoniously collaborating with colleagues from diverse disciplines to fuel innovation and achieve collective goals, propelling fintech ventures to new heights |

Let’s not forget, the importance of each skill can vary. It depends on the specific role, the company, and the project. For instance, a fintech engineer working on an AI-based trading algorithm might need strong machine learning skills. But if you’re developing a mobile payment app, UX/UI design skills might be more important. However, one thing is certain: a successful fintech engineer needs a blend of both hard and soft skills. It’s this mix that allows them to navigate the challenging but rewarding waters of the fintech industry. So, if you’re embarking on a fintech career, take some time to assess your skill set. Identify any gaps and consider how you might fill them. Remember, every new skill you acquire is another step on your fintech journey.

The Learning Path: Education and Qualifications

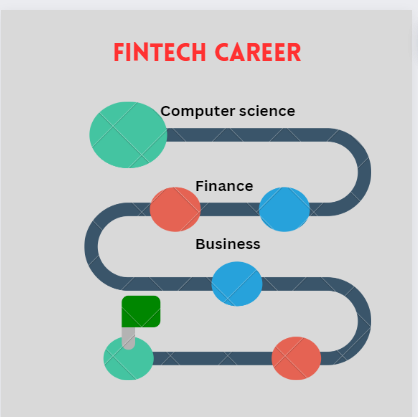

Roadmap to Fintech Career

Embarking on a Fintech Engineering career? There’s a range of educational and qualification routes you can explore. Let’s outline some of the typical options.

Degree Options

Fintech Engineering sits at the intersection of finance, technology, and business. As such, there are several degree paths you could consider:

- Computer Science: A degree in Computer Science provides a solid foundation in programming, algorithms, and data structures – all vital for a fintech engineer. It equips you with the tech skills to build and optimize financial systems.

- Finance: A Finance degree can help you understand the financial markets, banking operations, and investment strategies. It can give you the financial knowledge needed to create solutions that are relevant and impactful.

- Business: A Business or Business Administration degree can provide insights into market dynamics, business models, and customer needs. This can enable you to create commercially viable fintech solutions.

- Fintech-Specific Degrees: Some universities now offer specialized fintech degrees. These programs blend finance, technology, and business courses to provide a comprehensive fintech education. For example, the University of California, Berkeley, and the New York University Stern School of Business both offer Masters’s programs in Financial Technology.

Certifications in Fintech Engineering

In addition to formal education, certifications can play a key role in a fintech career. They can help you specialize in certain areas, stay current with industry trends, or gain a competitive edge. Here are a few examples:

- Certified Information Systems Security Professional (CISSP): This certification is highly respected in the cybersecurity field. It’s ideal if you want to focus on the security aspect of fintech engineering.

- Microsoft Certified: Azure AI Engineer Associate: If you’re interested in applying AI in fintech, this certification can be a good choice. It provides a grounding in using Azure services to build AI solutions.

- Professional Certificate in Fintech (edX): This online certification from the University of California, Berkeley, offers a broad overview of key fintech concepts and technologies.

Lifelong Learning

In the rapidly evolving fintech field, ongoing learning is vital. Attend industry seminars, follow fintech blogs, take online courses, or join fintech communities. These can help you stay updated and network with like-minded professionals.

Remember, there’s no one-size-fits-all in education. The right path depends on your interests, career goals, and personal circumstances. Some fintech engineers might have a Computer Science degree, while others might have a Business degree and learned coding on the job. Some might have multiple degrees, while others might have forged a path through online learning and certifications.

The key is to build a solid foundation in finance, technology, and business – and remain committed to lifelong learning. With this approach, you can chart a successful course in the vibrant world of fintech engineering.

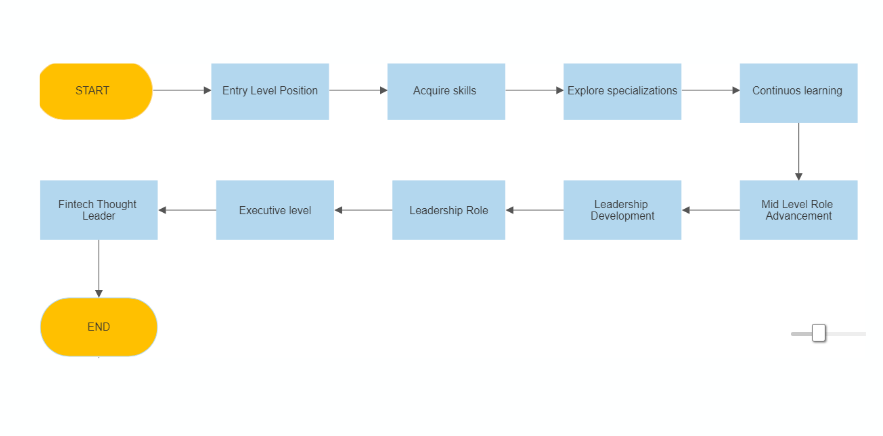

Plotting Your Career Path in Fintech Engineering

Flowchart for entry-level to leadership roles in fintech

Embarking on a fintech engineering career is an exciting journey. But where do you start? And how can you progress? Let’s trace a typical career path from entry-level roles to leadership positions.

Entry-Level Roles

As a newcomer in fintech, you’ll likely start in a junior role. Here are some common titles:

- Junior Fintech Engineer: You’ll work under the supervision of more experienced engineers, assisting in tasks like coding, testing, and debugging. It’s a great way to learn the ropes and gain practical experience.

- Fintech Analyst: This role involves analyzing financial data and market trends. You’ll likely work closely with data scientists and business strategists to develop insights that inform fintech solutions.

- Associate Product Manager: In this role, you’ll assist in managing fintech products, often working closely with developers, marketers, and other stakeholders. It’s a good role if you’re interested in the business side of fintech.

Mid-Level Roles

As you gain experience and develop your skills, you can move into more senior roles:

- Fintech Engineer: You’ll take on more responsibility in designing, developing, and maintaining fintech systems. You might also start to specialize in certain areas, such as AI, blockchain, or cybersecurity.

- Data Scientist: If you’ve developed strong data skills, a data scientist role could be a good fit. You’ll use statistical models and machine learning algorithms to extract insights from financial data.

- Product Manager: You’ll oversee the development of fintech products, ensuring they meet customer needs and align with business objectives. This role requires a good understanding of both the tech and business sides of fintech.

Senior-Level Roles

With substantial experience and proven expertise, you can aim for leadership roles:

- Senior Fintech Engineer: You’ll lead the design and implementation of complex fintech systems. You might also mentor junior engineers and make strategic tech decisions.

- Data Architect: In this role, you’ll design data systems that can handle large volumes of financial data effectively and securely.

- Product Director: You’ll set the strategic direction for fintech products, oversee product teams, and ensure products deliver business value.

It’s important to note that this is a typical path, but it’s not the only one. Fintech is a diverse field, and there are many ways to carve out a successful career. Some engineers might move into consulting roles, others might start their own fintech startups. The key is to continually learn, gain experience, and take on new challenges. That’s how you grow in a fintech engineering career.

Fintech Engineering: A Look into the Future

The fintech industry is poised for a thrilling future. Technologies like AI, blockchain, and machine learning are shaping the sector in unprecedented ways. Let’s look at how these technologies might influence the coming years.

AI and Machine Learning

AI and Machine Learning are becoming increasingly vital in the fintech sector. Here’s what to anticipate:

- Personalized Banking: Using AI, banks can personalize services to individual customers. From tailored financial advice to custom savings plans, AI can make banking more personalized than ever.

- Automated Trading: Machine learning algorithms can analyze vast amounts of financial data to predict market trends. This can automate trading and investment decisions, potentially increasing efficiency and accuracy.

- Fraud Detection: AI can recognize patterns in financial transactions to detect fraud. As AI algorithms become more advanced, we can expect even more effective fraud prevention tools.

Blockchain

Blockchain technology is also set to revolutionize fintech:

- Secure Transactions: Blockchain’s decentralized nature can make financial transactions more secure and transparent. This can reduce fraud and build trust in financial systems.

- Smart Contracts: These are self-executing contracts with terms of the agreement directly written into code. They can automate and secure many financial processes, from loans to insurance claims.

The Future of Fintech Engineering

So, what does this mean for the future of fintech?

- Increased Efficiency: As technologies automate more financial processes, we can expect greater efficiency. Transactions will be faster, and there will be less manual intervention.

- More Security: Advanced AI algorithms and blockchain technology can make financial systems more secure.

- Better Customer Experience: Personalization, faster transactions, and enhanced security can all improve the customer experience. Fintech will continue to make finance more accessible and user-friendly.

The fintech industry’s future is bright and exciting. Emerging technologies are paving the way for a new era of financial services – more efficient, secure, and customer-centric. As a fintech engineer, you’ll have the opportunity to be at the forefront of this revolution.

The Fintech Community: Networking Opportunities

In the dynamic world of fintech, networking is key. It helps you stay updated with industry trends, gain new insights, and discover opportunities. Here are some ways to build and maintain your professional network:

Professional Groups

Joining professional groups can be a valuable way to connect with peers and industry leaders:

- LinkedIn Groups: Platforms like LinkedIn have numerous groups dedicated to fintech, such as “Fintech Circle” and “Global Fintech Network”. These are great places to share ideas and learn from others.

- Meetup Groups: Look for fintech-related Meetup groups in your area. They often organize talks, workshops, and networking events.

Conferences and Webinars

Conferences and webinars are excellent platforms to learn and network:

- Money20/20: This global conference focuses on the future of money. It’s a great event to hear from industry leaders and meet like-minded professionals.

- Fintech Webinars: Many companies and organizations offer webinars on various fintech topics. Websites like Eventbrite often list these events.

Hackathons

Hackathons can be a fun and intense way to network while developing your skills:

Fintech Hackathons: These events challenge participants to create innovative fintech solutions in a limited time. They can be a great way to meet potential collaborators, learn new skills, and showcase your abilities.

Networking Tips

Lastly, remember that effective networking is about building relationships. Don’t just focus on what others can do for you, think about how you can contribute to the community. Share your knowledge, help others, and be genuinely interested in what others have to say. This approach can help you build strong and meaningful professional connections.

Potential Employers in the Fintech Space

In the fintech industry, there’s a diverse range of potential employers. Whether you’re drawn to established financial institutions or exciting startups, there’s an opportunity for you. Let’s look at some examples:

Traditional Companies

Several traditional financial companies have embraced fintech to enhance their services:

- J.P. Morgan: This global financial institution invests heavily in fintech to improve its banking services. With roles in areas like AI, blockchain, and data science, there are numerous opportunities for fintech engineers.

- Goldman Sachs: This investment banking giant also has a significant fintech focus. It has developed digital platforms like Marcus and is always on the lookout for tech talent.

- Visa: As a payment technology company, Visa is keenly involved in fintech. From digital wallets to secure payment technologies, Visa offers a range of fintech roles.

Startups

There are also many startups disrupting the traditional finance industry:

- Stripe: This tech company provides APIs that enable businesses to accept payments online. It’s at the forefront of payment technology and offers a dynamic work environment.

- Robinhood: This investment app is democratizing finance by making investing accessible to everyone. If you’re passionate about breaking down financial barriers, Robinhood could be a good fit.

- Plaid: Plaid develops infrastructure to allow various apps to connect with users’ bank accounts. It’s a key player in the fintech ecosystem and offers exciting roles.

A World of Opportunities

Whether you choose a traditional company or a startup, the fintech industry offers a wealth of opportunities. You might design cutting-edge payment technology at Visa, help democratize finance at Robinhood, or enable new fintech solutions at Plaid. It’s about finding the right fit for your interests, values, and career goals.

Summary

Fintech engineers play a crucial role in developing cutting-edge solutions, leveraging their expertise in finance, data analysis, and programming. With the increasing demand for digital financial services, Fintech professionals are in high demand. Pursuing a career in Fintech Engineering allows individuals to become part of a dynamic and fast-paced industry, driving financial transformation and staying ahead of the curve.

Frequently Asked Questions

- What is fintech engineering?

A. Fintech engineering refers to the application of engineering principles, technology, and software development in the financial industry to create innovative solutions and products. It involves developing software, platforms, and applications that address financial challenges and improve services in areas such as mobile payments, online banking, blockchain, algorithmic trading, and more.

2. What skills do fintech engineers need?

A. Fintech engineers typically require a strong foundation in computer science, programming languages (such as Python, Java, or C++), data structures, and algorithms. Additionally, expertise in areas like financial modeling, cybersecurity, blockchain, artificial intelligence, and machine learning is beneficial.

3. How does fintech engineering differ from traditional finance or software engineering?

A. Fintech engineering combines the principles of finance and software engineering to develop solutions specific to the financial industry. Unlike traditional finance, fintech engineering emphasizes technology-driven innovation and automation. It also differs from generic software engineering as it involves specialized knowledge of financial systems, security protocols, regulatory compliance, and data privacy.

4. What are some popular use cases of fintech engineering?

A. Fintech engineering has led to numerous innovative solutions, such as peer-to-peer lending platforms, mobile payment apps, robo-advisors for investments, blockchain-based smart contracts, algorithmic trading systems, digital wallets, and fraud detection systems, to name a few.

5. What are the challenges faced by fintech engineers?

A. Fintech engineers encounter various challenges, including ensuring the security of financial data and transactions, complying with strict regulations like GDPR or KYC (Know Your Customer), integrating with legacy banking systems, handling large-scale data processing, and addressing scalability issues in high-demand scenarios.

6. Is fintech engineering prone to cyberattacks?

Yes, fintech systems are attractive targets for cyberattacks due to the valuable financial data they handle. Fintech engineers must implement robust security measures, such as encryption, two-factor authentication, and regular security audits, to protect against breaches and unauthorized access.

7. How does fintech engineering leverage artificial intelligence and machine learning?

A. Fintech engineering often employs AI and machine learning to analyze large datasets, detect patterns, predict market trends, assess credit risk, personalize user experiences, and identify fraudulent activities in real time. These technologies enhance decision-making and streamline financial processes.

8. What role does blockchain play in fintech engineering?

A. Blockchain technology, with its decentralized and immutable nature, has transformative potential in fintech. Fintech engineers use blockchain for secure and transparent transactions, creating digital assets, managing supply chains, and facilitating cross-border payments without intermediaries.

9. Are there any regulatory considerations in fintech engineering?

A. Yes, fintech engineering must adhere to financial regulations and compliance standards, varying depending on the region of operation. Engineers need to be aware of legal requirements regarding data protection, customer privacy, anti-money laundering (AML), and other financial services regulations.

10. How can one pursue a career in fintech engineering?

A. Aspiring fintech engineers should begin by acquiring a strong foundation in computer science, programming, and mathematics. Pursuing relevant academic degrees in computer science, finance, or related fields is helpful. Engaging in fintech-related projects, internships, and staying updated on industry trends and technologies are also valuable steps to enter the fintech engineering domain.

To read about career in Artificial Intelligence click here