Introduction

Embarking on a career in investment banking is akin to setting sail on a voyage through the intricate world of finance. It’s a dynamic field that beckons those with a flair for numbers, a penchant for challenges, and an unwavering passion for driving growth.

Within this expansive landscape, individuals find themselves immersed in diverse sectors, including real estate, healthcare, and equity banking. Each sector presents unique avenues for professional development and achievement.

In this article, we delve into the multifaceted realm of investment banking, exploring the pivotal roles of investment bankers, the nuances of real estate and healthcare investment banking, prominent companies in the field, and the intriguing topic of investment banking income.

- The Role of Investment Bankers: A Comprehensive Overview

- How is AI affecting investment banking?

- Real Estate Investment Banking: Bridging Finance and Property Markets

- Investment Banking Income: Understanding Compensation Structures and Expectations

- Healthcare Investment Banking: Merging Finance with Healthcare Innovations

- Here are the key takeaways

- FAQs

The Role of Investment Bankers: A Comprehensive Overview

Investment bankers occupy a central position in the financial realm, enabling capital mobilization, orchestrating mergers and acquisitions, and dispensing strategic financial counsel to corporations, governments, and other entities. Now, let’s plunge into the intricacies of their role, which encompasses educational prerequisites, career trajectories, and critical responsibilities.

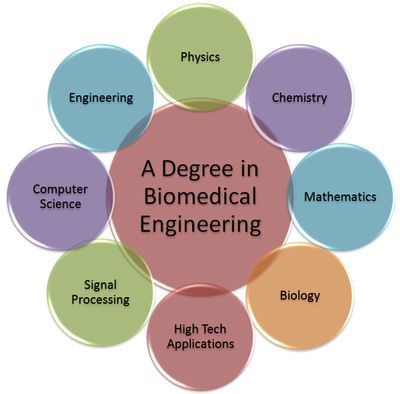

Education and Qualifications

- A bachelor’s degree in finance, economics, accounting, or a related field is typically required to enter the field of investment banking.

- Many investment bankers pursue advanced degrees such as a Master of Business Administration (MBA) or a Chartered Financial Analyst (CFA) designation to enhance their skills and credibility.

- Strong analytical skills, financial acumen, and proficiency in financial modeling and valuation techniques are essential for success in this field.

Career Path

- Entry-level positions in investment banking often start with analyst roles, where individuals gain hands-on experience in financial analysis, modeling, and research.

- Analysts may then progress to associate positions, where they take on more client-facing responsibilities and play a larger role in deal execution.

- Senior roles in investment banking include vice presidents, directors, and managing directors, who oversee deal teams, manage client relationships, and drive business development initiatives.

Key Responsibilities

- Mergers and Acquisitions (M&A): Investment bankers advise clients on strategic transactions such as mergers, acquisitions, divestitures, and joint ventures. They conduct financial analyses, perform due diligence, and structure deals to maximize value for their clients.

- Capital Raising: Investment bankers assist companies in raising capital through debt or equity offerings. They help clients navigate the capital markets, prepare offering documents, and facilitate investor presentations.

- Financial Advisory: Investment bankers provide strategic financial advice to clients on a wide range of issues, including corporate restructuring, capital allocation, and risk management strategies.

How is AI affecting investment banking?

Artificial intelligence (AI) is significantly reshaping the landscape of investment banking, ushering in a new era of productivity and innovation. Let’s delve into the specifics of how AI impacts this critical role.

Generative AI: This transformative technology, powered by transformer models, holds immense promise for investment banks.

- Generative AI: This transformative technology, powered by transformer models, holds immense promise for inventment banks. According to Deloitte, the top 14 global investment banks can enhance their front-office productivity by 27%–35% by leveraging generative AI. This boost translates to an additional revenue of US$3.5 million per front-office employee by 2026. The allure of generative AI lies in its ability to automate tasks, improve worker productivity, and free up resources for innovation.

- Applications of Generative AI:

- Automating Tasks: Large language models (LLMs) can automate various functions across the transaction life cycle, saving costs and time.

- Enhancing Worker Productivity: Generative AI levels the playing field, benefiting lower-skilled employees by improving their outputs and productivity.

- Innovation Catalyst: By automating routine tasks, investment bankers can focus more on client interactions and strategic initiatives.

- Real-World Impact:

In summary, AI is revolutionizing investment banking, empowering professionals to work smarter, serve clients better, and drive growth.

Real Estate Investment Banking: Bridging Finance and Property Markets

Real Estate Investment Banking (REIB) plays a pivotal role in the financial landscape, acting as a bridge between capital markets and the dynamic real estate sector. In this blog post, we’ll unravel the intricacies of REIB, focusing on its core functions, key players, and the critical concept of bridging finance.

Real estate investment banking serves as the nexus between finance and property markets, facilitating transactions, financing arrangements, and strategic advisory services in the dynamic real estate sector. Let’s explore the intricacies of this specialized field, including its role in bridging finance and property markets, key functions, and career opportunities.

The realm of real estate investment banking offers a variety of services specifically designed to meet the requirements of the real estate industry. These services involve organizing and carrying out transactions, like property purchases, development initiatives and offerings of asset backed securities. Real estate investment bankers play a role by connecting investors, developers and property owners with capital providers. This enables the inflow of funds, into the real estate market fostering growth and promoting innovation.

Main Functions

Raising Funds: Real estate investment bankers play a role, in helping property developers and owners secure funding for their real estate projects. They explore financing options such, as debt, equity and structured finance solutions.

Advisory Services: These professionals offer advice to clients across a range of real estate transactions. This includes providing guidance on mergers and acquisitions ventures and portfolio restructurings.

Financial Analysis: Real estate investment bankers conduct analyses and due diligence to evaluate the viability and profitability of real estate investments. Their insights assist clients in making informed decisions.

Career Opportunities

- Entry-level positions in real estate investment banking typically start with analyst roles, where individuals gain exposure to financial modeling, market research, and transaction execution.

- Analysts may then progress to associate positions, where they take on more client-facing responsibilities and play a larger role in deal origination and execution.

- Senior roles in real estate investment banking include vice presidents, directors, and managing directors, who oversee deal teams, manage client relationships, and drive business development initiatives.

Real Estate Investment Banking involves assessing and structuring real estate deals, managing risks, and securing financing for various real estate projects. It encompasses commercial and residential properties, hotels, retail centres, industrial sites, and more. For a comprehensive guide, you can explore this detailed article: Real Estate Investment Banking: Deals, Valuation, and More.

Top Real Estate Investment Banking Firms

- If you’re interested in learning about the leading firms in this field, here are some notable ones:

- The Blackstone Group

- Starwood Capital Group

- Lone Star Funds

- Colony Capital

- LaSalle Investment Management

- Tishman Speyer

- The Carlyle Group

- Goldman Sachs Real Estate Principal Investment Area

- Brookfield Asset Management

- Morgan Stanley Real Estate Investing

- And many more! You can explore the full list and details in this resource: Top Firms in Investment Real Estate2.

Investment Banking Income: Understanding Compensation Structures and Expectations

Investment banking is renowned for its high stakes, fast-paced environment, and lucrative rewards. As aspiring bankers from the Gen-Z and Gen-Alpha generations enter this field, it’s crucial to grasp the nuances of compensation.

Compensation varies by region (e.g., Asia-Pacific has lower pay)

Investment banking income is a dynamic interplay of base salaries, bonuses, and stock incentives. Gen-Z and Gen-Alpha professionals must navigate these structures, anticipate changes, and maintain a holistic perspective on their careers.

What to expect?

- Gen-Z and Gen-Alpha professionals can expect competitive base salaries, even at entry levels.

- Bonuses are performance-based and vary significantly.

- Investment banks increasingly offer stock-based bonuses.

- Gen-Z and Gen-Alpha bankers should weigh compensation against lifestyle.

- No fixed promotion timeframe (based on performance and seniority)

- Balancing work intensity and personal time matters.

- Stock bonuses align bankers’ interests with the long-term success of the firm.

- Understand local norms and expectations.

- Compensation varies by region.

Healthcare Investment Banking: Merging Finance with Healthcare Innovations

Healthcare investment banking represents the intersection of finance and healthcare innovations, where financial expertise meets cutting-edge medical technologies and treatments. Let’s delve into the world of healthcare investment banking, exploring its role in driving innovation, financing breakthroughs, and shaping the future of healthcare.

Driving Advances in Healthcare Through Financial Support

Healthcare investment bankers play a role, in funding and assisting healthcare companies, startups and research institutions that are leading the way, in groundbreaking medical breakthroughs.

By offering resources, strategic guidance and specialized knowledge of the industry healthcare investment bankers empower healthcare innovators to expedite the progress and introduction of life saving treatments, medical devices and therapies.

Investing in Advancements in Healthcare

Healthcare investment banking covers a variety of services designed specifically for the healthcare industry. These services include facilitating mergers and acquisitions securing funding and forming partnerships.

Investment bankers play a role, in helping healthcare companies secure funding for their research and development efforts well as supporting their growth through different financing avenues, like private equity, venture capital, public offerings and debt financing.

Shaping the Future of Healthcare

Playing a role, in the evolution of healthcare investment bankers not only provide financial support for innovative healthcare initiatives but also offer valuable strategic advice to companies in the industry. Their expertise spans transactions like mergers, acquisitions, divestitures and licensing agreements. By fostering partnerships and collaborations, between healthcare companies, investors and research institutions these professionals actively contribute to the progress of science and the provision of top-notch healthcare services.

Exciting Career Opportunities

- Healthcare investment banking offers exciting career opportunities for finance professionals passionate about making a difference in the healthcare industry.

- Entry-level positions in healthcare investment banking typically start with analyst roles, where individuals gain exposure to financial analysis, market research, and transaction execution.

- Analysts may then progress to associate positions, where they take on more client-facing responsibilities and play a larger role in deal origination and execution.

- Senior roles in healthcare investment banking include vice presidents, directors, and managing directors, who oversee deal teams, manage client relationships, and drive business development initiatives.

If you are interested in reading about other career options, look no further!

Here are the key takeaways

- The Role of Investment Bankers: The article provides a comprehensive overview of the educational qualifications, career paths, and key responsibilities of investment bankers, who facilitate capital mobilization, mergers and acquisitions, and financial advisory services for various entities.

- AI and Investment Banking: The article discusses how artificial intelligence (AI), especially generative AI, is reshaping the landscape of investment banking, enhancing productivity, automating tasks, and fostering innovation.

- Real Estate Investment Banking: The article explores the specialized field of real estate investment banking, which acts as a bridge between capital markets and the dynamic real estate sector, offering services such as raising funds, advisory services, and financial analysis.

- Healthcare Investment Banking: The article delves into the world of healthcare investment banking, which merges finance with healthcare innovations, providing financial support, strategic guidance, and specialized knowledge to healthcare companies, startups, and research institutions.

FAQs

- What does an investment banker do?

- Investment bankers provide financial advisory services to corporations, governments, and other entities. They help clients raise capital, facilitate mergers and acquisitions, and provide strategic financial advice.

- How do you become an investment banker?

- To become an investment banker, individuals typically need a bachelor’s degree in finance, economics, or a related field. Many also pursue advanced degrees such as an MBA or CFA. Internships and networking are crucial for gaining entry into the field.

- What is the salary of an investment banker?

- The salary of an investment banker varies depending on factors such as experience, location, and employer. Entry-level analysts may start with salaries ranging from $70,000 to $100,000, while managing directors at top firms can earn several million dollars annually.

- What skills do investment bankers need?

- Investment bankers need strong analytical skills, financial modeling expertise, excellent communication skills, and the ability to thrive in a fast-paced, high-pressure environment. Attention to detail, problem-solving abilities, and proficiency in Excel are also crucial.

- What is a day in the life of an investment banker like?

- A typical day for an investment banker involves conducting financial analysis, preparing presentations and pitch books, attending client meetings, and working on deal execution tasks such as due diligence and valuation.

- What are the different types of investment bankers?

- Investment bankers can specialize in various sectors such as mergers and acquisitions (M&A), capital markets, restructuring, and industry-specific areas like healthcare or real estate investment banking.

- What is the difference between an investment banker and a commercial banker?

- Investment bankers focus on providing financial advisory services and facilitating capital raising and M&A transactions for corporations and institutions, while commercial bankers primarily deal with providing loans and other banking services to businesses and individuals.

- What are the top investment banking firms?

- Some of the top investment banking firms include Goldman Sachs, JPMorgan Chase, Morgan Stanley, Bank of America Merrill Lynch, and Citigroup. These firms are renowned for their global presence, extensive client networks, and track record of successful deals.

- What are the working hours for investment bankers?

- Investment bankers often work long hours, including late nights and weekends, especially during busy deal cycles. It’s not uncommon for investment bankers to work 80 to 100 hours per week during peak periods.

- What is the job outlook for investment bankers?

- The job outlook for investment bankers is influenced by factors such as economic conditions, regulatory changes, and technological advancements. While the field remains competitive, there is a consistent demand for talented professionals with strong financial skills and industry expertise.